FATCA-CRS Annexure for Individual Accounts Annexure 1 2015 free printable template

Show details

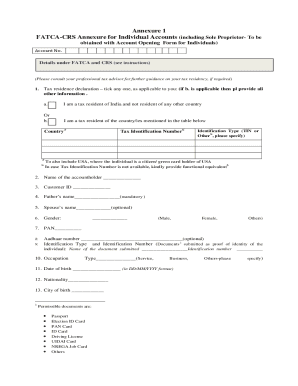

Appendix 1 FLATCARS Appendix for Individual Accounts (including Sole Proprietor To be obtained with Account Opening Form for Individuals) Account No. Details under FATWA and CRS (see instructions)

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign bank of baroda fatca crs annexure 1 form

Edit your fatca crs declaration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bob fatca form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing this form is essential for compliance with the foreign account tax compliance act fatca undefined online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fatca crs annexure for individual accounts form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FATCA-CRS Annexure for Individual Accounts Annexure 1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out bank of baroda annexure 1 form

How to fill out Bank of Baroda Annexure:

01

Gather all necessary information and documentation required for the annexure.

02

Complete the personal details section of the annexure, including your name, address, contact information, and any other requested details.

03

Provide details regarding the account for which the annexure is being filled, including the account number, type of account, and any other relevant information.

04

Fill in the details of the transactions or activities that need to be reported in the annexure, ensuring accuracy and completeness.

05

Review the filled annexure for any errors or omissions, making any necessary corrections.

06

Sign and date the annexure as required, ensuring that all information provided is true and accurate.

07

Submit the filled annexure to the Bank of Baroda as directed.

Who needs Bank of Baroda Annexure:

01

Individuals or entities who have transactions or activities that need to be reported to the Bank of Baroda.

02

Customers of Bank of Baroda who are required to provide additional information or documentation for specific purposes, such as KYC (Know Your Customer) compliance.

03

Anyone who requires an annexure specifically provided by the Bank of Baroda for a particular process or requirement.

Fill

fatca crs annexure for individual accounts bank of baroda

: Try Risk Free

People Also Ask about bank of baroda fatca form

Who needs to fill out FATCA form?

FATCA requirements impact U.S taxpayers and overseas financial institutions: U.S. taxpayers with foreign accounts and assets may need to file Form 8938: Statement of Specified Foreign Financial Assets with their annual U.S. Income Tax Return.

How to fill out a FATCA form?

The CRS & FATCA Self-certification form will ask you to confirm the following: Your full name. Your date of birth. Your country, town/city of birth. Your citizenship. Your current residence, and if applicable, mailing address. Whether you are a US Person. Your country/countries of residence for tax purposes.

What is the full form of FATCA in Bank of Baroda?

Foreign Account Tax Compliance provisions (commonly known as FATCA) are contained in the US Hire Act 2010.

Is FATCA mandatory?

FATCA obligates every Indian financial institutions/mutual funds to provide required tax related information to Indian Tax authorities of accounts held by specified US Persons.

How do I fill out a FATCA form?

How to fill FATCA CRS declaration for individual? Basic Information: In this field, you must provide your name, PAN Card number, and birthdate. Part 1: This part requires you to enter your birthplace, citizenship, legal address for tax reasons, and whether you are a US resident or not.

Is it necessary to fill FATCA form?

FATCA obligates every Indian financial institutions/mutual funds to provide required tax related information to Indian Tax authorities of accounts held by specified US Persons. Therefore when you open a new account with mutual fund you need to provide information regarding your tax status.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fatca form bank of baroda directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign fatca declaration and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I create an eSignature for the fatca form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your how to fill fatca crs declaration form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I fill out sample filled form of bank of baroda on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your bank of baroda fatca form for individual, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is FATCA-CRS Annexure for Individual Accounts Annexure 1?

FATCA-CRS Annexure for Individual Accounts Annexure 1 is a form used to report information regarding individual accounts that are subject to the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). It is designed to ensure compliance with international tax regulations.

Who is required to file FATCA-CRS Annexure for Individual Accounts Annexure 1?

Financial institutions that maintain accounts for individuals and are required to comply with FATCA and CRS regulations must file the FATCA-CRS Annexure for Individual Accounts Annexure 1. This includes banks, investment firms, and other entities that hold such accounts.

How to fill out FATCA-CRS Annexure for Individual Accounts Annexure 1?

To fill out the FATCA-CRS Annexure for Individual Accounts Annexure 1, individuals should provide personal information such as name, address, date of birth, tax identification number, and other required details. Institutions must ensure they complete the form accurately, capturing all relevant information according to the provided guidelines.

What is the purpose of FATCA-CRS Annexure for Individual Accounts Annexure 1?

The purpose of the FATCA-CRS Annexure for Individual Accounts Annexure 1 is to facilitate the exchange of tax-related information between countries and to combat tax evasion. It helps governments track and verify the tax liabilities of individuals holding accounts in foreign jurisdictions.

What information must be reported on FATCA-CRS Annexure for Individual Accounts Annexure 1?

The information that must be reported on FATCA-CRS Annexure for Individual Accounts Annexure 1 includes the account holder's name, address, date of birth, country of tax residence, tax identification number, account number, and balance or value of the account at the end of the reporting period, among other required details.

Fill out your FATCA-CRS Annexure for Individual Accounts Annexure 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Of Baroda Annexure 1 Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to bob annexure 1

Related to annexure 1 bank of baroda

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.